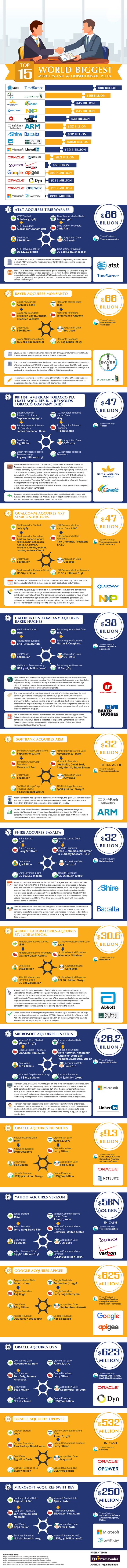

Top 15 Biggest Mergers and Acquisitions in the world

1. MICROSOFT acquires SWIFT KEY for $250 mn on Feb 2nd, 2016. Jon Reynolds and Ben Medlock are the founders of Swift Key and the master minds behind Microsoft are Bill Gates and Pau Allen. They are dealing in the Android, iOs, AI industry with Microsoft being founded in the year 1974 and Swift key on August 1, 2008.

2. OPOWER acquired by ORACLE CORPORATION on May, 2016 with a deal of $532 Mn , all in cash. Oracle- serving the software industry was founded in the year 1977 on June 6 by Larry Ellison and Opower in the year 2007 by Alex Laskey and Daniel Yates.

3. ORACLE acquired DYN on Spt 8, 2016 for $623 mn. They deal in internet, Web hosting, Saas and cloud computing with Oracle having more experience as it started in the year 1977 on June 16th by Larry Ellison. Whereas DYN was founded by Tom Daly and Jeremy Hitchcook in 1998.

4. Acquisition of GOOGLE by APIGEE for $ 625mn on Sep 8, 2016. Google was founded on Sep 7, 1998 by Larry Page and Serry Bin while Raj Singh fouded Apigee on June 1st, 2004. They deal in cloud data services, enterprise software and IT.

5. VERIZON acquires the search engine YAHOO for $ 5bn in July 2016. Yahoo was started in the year 1984 by Jerry Yang and David Filo concentrating on Telecommunications industry. Verizon is an American Telecom giant founded in the year 2000 by Delaware. The revenues noted as of 2015 by yahoo was $ 4.968 bn and $ 131.62 bn by Verizon.

6. NETSUITE acquired by ORACLE for $9.3bn in the year 2016. Oracle was founded quite a years ago in 1977 by larry Ellison while Netsuite a little later in the year 1998 by Evan Goldberg. They focus on CRM, Saas, ios etc.

7. MICROSOFT acquires LINKEDIN for $26.2bn in June, 2016. Microsoft was started in 1975 by Bill Gates and Paul Allen while LinkedIn quite later in 2002 by a team of 5. Since, they are dealing in digital distribution, hence, revenues (2015) for Microsoft were $ 85.32bn and $3bn for LinkedIn. LinkedIn has vast networking and CRM capabilities which would help Microsoft to set a base in the corporate arena.

8. ABBOTT LABORATORIES acquires ST. JUDE MEDICAL for $ 30.6bn on April 2016. Abbott being probably one of the oldest was started in 1888 by Wallace Calvin Abbott and St. Jude was founded in 1976 by Manuel A. Villafana, both dealing in healthcare. The revenues observed as of FY2015 were $ 20.405bn by Abbott and $6.1 bn by St. Jude. After the merger, a complementary portfolio of cardiovascular products has been formed, thus, gaining more pricing power in the market.

9. Acquisition of BAXALTA by SHIRE for $32bn on Jan 2016 but the deal completed successfully in June 2016. Shire started way back in 1986 by Harry Stratford while Baxalta is just an year old founded in 2015 by Jose E. Almeida. Both companies deal in biotechnology and in treating rare diseases.

10. SOFTBANK acquires ARM HOLDINGS for $32bn on July 18, 2016. SoftBank (Japan) was started in 1981 by Masayoshi Son while ARM Holdings was founded in 1990 by a team of three masterminds focussing on telecommunications industry. As ARM holdings provides parts of chip design used in iphones, it recorded a revenue of € 968.3mn.

11. Acquisition of BAKER HUGHES by HALLIBURTON for $38mn in the year 2016. Being in the oilfield services & equipment industry, they earn huge profitable revenues. Halliburton was founded in the year 1919 by Erle P. Halliburton while Baker Hughes started quite late in 1987 by Martin S. Craighead. After acquisition it has gained the second position in world’s biggest energy services provider.

12. QUALCOMM acquires NXP SEMICONDUCTORS for $47bn in Oct 2016. It was an all cash deal and now the combined entity would observe more than $30 bn revenue annually. Qualcomm started in the year 1985, July by a group of 7 while NXP is a young company founded in the year 2008 by Rick Clemmer. As of FY 2015, Qualcomm earned $25.3bn revenues and NXP had a figure of $6.1 bn in revenues.

13. BRITISH AMERICAN TOBACCO acquires R.J. REYNOLDS TOBACCO COMPANY for a value of $47 bn on Oct 2016. This acquisition is little surprising because an old company is acquired by a new one. BAT started in the year 1902 while JJR was founded in the year 1875 by R.J. Reynolds. BAT is based in London and already owns 42.2% stake in Reynolds. But now it wishes to offer cash and stock worth $56.50 which accounts to 20% premium for the remaining share-holding.

14. BAYER AG acquires MONSANTO for $66bn on Sep 2016. Bayer was founded on August 1, 1863 by two partners while Monsanto started its business in pharmaceuticals in the 1901. After merger, it has become world’s biggest seed and pesticide company.

15. AT&T acquires TIME WARNER for $86 bn on Oct 2016. AT&T was founded way back in 1983 by Alexander Graham Bell and now reported a revenue of $1468bn FY2015. On the other hand, $28.11bn was noted for Time Warner. Here FabPromoCodes researched and analyzed the data and created this infographic

Use this HTML code to share Top 15 Biggest Mergers and Acquisitions in the world 2016 on your website.

Created by Fabpromocodes